Présentation

Tendances Sociales

Engagement Ecologique

Culture et Emploi

Découvrir tout sur Redcrossnca

Introduction

Bienvenue sur Redcrossnca, le site généraliste qui vous informe et vous divertit. Nous sommes votre source pour les nouvelles, la culture et les perspectives sur les enjeux du monde moderne.

Informations Générales

Restez informé des dernières actualités et divertissements de l’actualité.

Actualités

Découvrez les dernières actualités et événements à travers le monde.

Environnement

Apprenez l’importance de protéger notre environnement et comment faire une différence.

Engagement social

Découvrez comment vous pouvez vous impliquer dans des causes sociales importantes.

Culture

Explorez les différentes formes d’art, de cinéma et de littérature à travers le monde.

Explorer le protefeuille

Découvrez nos dernières créations

Applications innovantes et sites web modernes

Explorez notre sélection de projets pour avoir un aperçu de nos compétences et de notre expertise dans le domaine de l’information.

Notre portfolio

Projets créatifs et fonctionnelles

Découvrez notre portefeuille pour voir comment nous avons utilisé la technologie et l’innovation pour répondre aux besoins de nos clients.

Nos derniers projets

Designs esthétiques et fonctionnelles

Plongez dans notre portefeuille pour voir comment nous avons combiné l’information et le design pour créer des projets uniques et efficaces.

Explorez des sujets et perspectives choisis

Découvrez les différentes facettes de notre site

Société

Soyez informé des enjeux sociaux actuels

Culture

Plongez dans l’art, l’histoire et les traditions du monde

Environnement

Explorez des solutions pour un avenir plus durable

Emploi

Obtenez des conseils et des ressources pour votre carrière

Découvrir un large choix de plans de prix pour vous aider à mieux comprendre vos options.

Informations sur nos offres de tarification pour vous aider à faire un choix éclairé.

Explorer et rester informé

Un arrêt de destination pour les dernières informations et offres abrégées pour en savoir plus.

Articles récents

Découvrez les derniers articles publiés sur notre site pour rester informé et engagé envers nos causes.

Panneau solaire photovoltaïque : votre avenir énergétique optimisé

Le panneau solaire photovoltaïque transforme la lumière du soleil en électricité, offrant une source d’énergie[…]

Rénovation énergétique : la satisfaction client avant tout

La rénovation énergétique transforme les logements en espaces plus confortables et moins énergivores. Garantir la[…]

Crédit auto : comment utiliser correctement un simulateur en ligne ?

Envie de financer votre nouvelle voiture sans tracas ? Un simulateur de crédit auto en[…]

Camping en Bretagne: le bonheur au bord de mer

Imaginez-vous réveillé par le doux chuchotement des vagues bretonnes, alors que la brise marine caresse[…]

Protection des bailleurs : optez pour l’assurance loyers impayés

Face à l’incertitude des loyers impayés, l’assurance s’impose comme un rempart pour les propriétaires. Cet[…]

Comparatif complet sur les sites de rencontre en ligne

À l’heure où les rencontres virtuelles grimpent en flèche, dénicher le bon site peut s’apparenter[…]

Développez l’esprit de vos enfants avec des jeux éducatifs

Votre enfant est une éponge pour apprendre; chaque jour est une aventure dans le royaume[…]

Verre sur mesure : guide pour un ajustement idéal

Choisir un verre sur mesure n’est jamais anodin; c’est toute l’harmonie d’un espace qui peut[…]

Coflix: votre nouveau choix pour du streaming premium

Êtes-vous à la quête d’une expérience de streaming de qualité supérieure? Coflix se distingue comme[…]

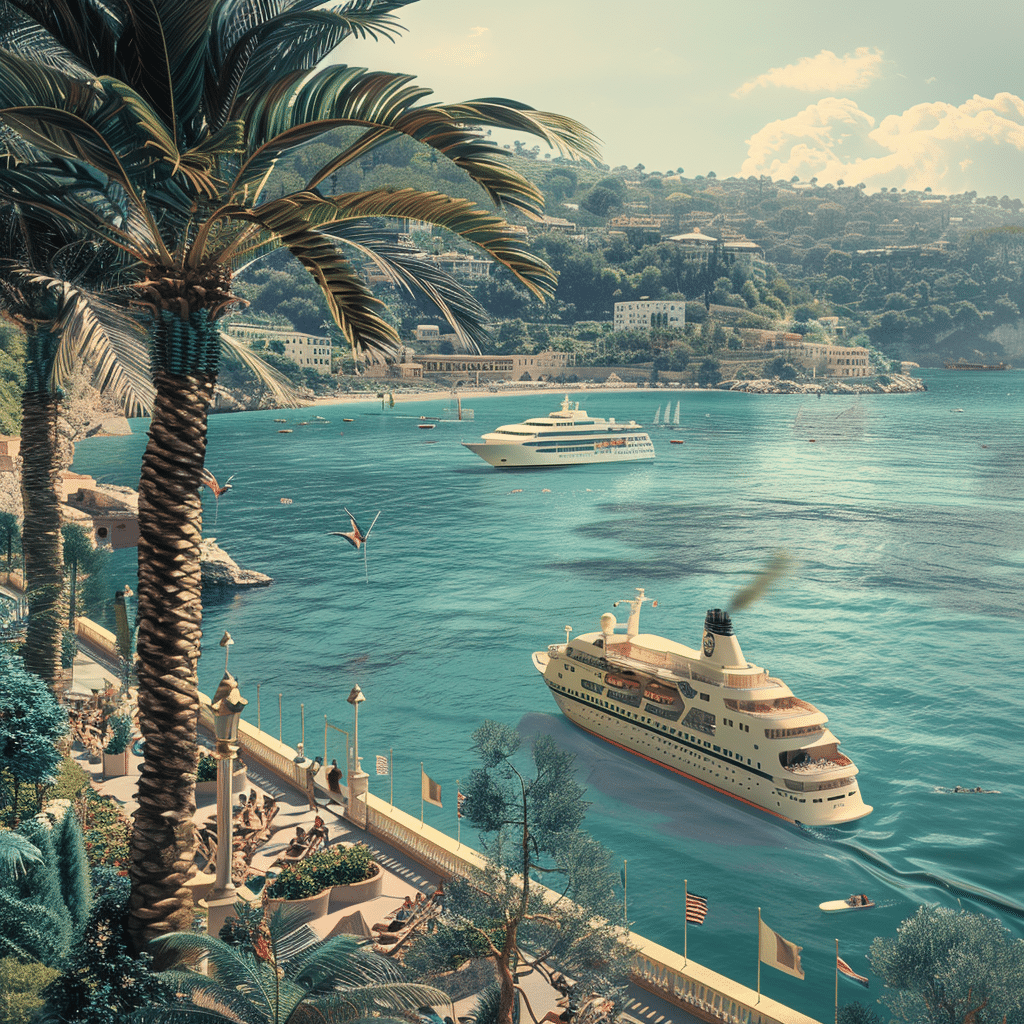

Découvrez les secrets des croisières en méditerranée

Entrez dans l’univers fascinant des croisières en Méditerranée et maîtrisez les subtilités d’un périple maritime[…]

Sécurité maison : stoppez les cambriolages efficacement

Votre maison est votre sanctuaire, mais la menace des cambriolages pèse constamment sur votre tranquillité[…]

Partir en voyage : top destinations à découvrir

L’envie de découvrir des horizons nouveaux vous titille? De Bali à la Patagonie, notre sélection[…]

Apprendre des langues étrangères avec globespeaker

Maîtriser une nouvelle langue se révèle être une aventure enrichissante. GlobeSpeaker offre des méthodes innovantes[…]

Maîtrisez la rédaction web pour captiver votre audience

Dans l’ère du numérique où capturer l’attention s’avère un challenge quotidien, maîtriser l’art de la[…]

Découvrez les top solutions d’épilation pour 2024

L’épilation évolue rapidement, et l’année 2024 marque l’arrivée de technologies révolutionnaires. Pourquoi s’adapter? Car ces[…]

Quelles techniques pour écrire des essais inspirés par Michel de Montaigne ?

En cherchant à explorer la nature de l’homme à travers l’écriture, vous avez probablement croisé[…]

Comment organiser une dégustation de thés du monde chez soi ?

L’art de la dégustation du thé est une pratique qui transporte les amateurs de cette[…]

Comment créer un cours sur l’analyse des romans de Virginia Woolf ?

Virginia Woolf, grand nom de la littérature du 20ème siècle, a su marquer l’histoire de[…]

Quelles initiatives les villes peuvent-elles prendre pour améliorer l’accès aux espaces verts en milieu urbain ?

C’est la question brûlante que se posent de nombreux urbains, soucieux de leur qualité de[…]

Quelles sont les techniques pour débuter en peinture aquarelle en tant qu’amateur ?

Qui n’a jamais rêvé de laisser s’exprimer son côté artistique avec un pinceau à la[…]